A Fractional CMO is an experienced marketing executive, ready to begin performing on Day One,...

Customer Intelligence for Small Businesses is Data-Driven

By systematically collecting data during all customer interactions, businesses of all sizes are using Customer Relationship Management (CRM) systems to improve their strategic decision-making.

“An organization’s business results, both positive and negative, are the sum total of the quality, timeliness and accuracy of its decisions, as well as its ability to execute on those decisions,” – Gartner’s Top Trends in Data and Analytics for 2021.

Almost everyone knows that tech giants make massive profits by gathering data about the billions of people who interact with their digital platforms. The data these corporations corral not only helps convert split seconds of attention into sales, but a deeper analysis of the data helps these companies improve customer service, focus development efforts, and evolve their market positions.

It's not just big tech going all-in on data. Self-described futurist, Forbes contributor and thought leader Bernard Marr describes six ways small companies can use big data here:

- Understanding what makes your customers tick

- Identifying trends

- Checking out the competition

- Improving operations

- Recruiting and managing talent

- Tweaking your business model

According to the Forbes Technology Council, businesses of all sizes purchase business analytics solutions, and “nearly all (90%) corporations value information as a critical enterprise asset and analytics as an essential competency.”

Is my company too small to benefit from data analysis?

Data analysis works for global brands, but it can also benefit lesser-known names looking to grow into something bigger. Business analytics provides actionable insights that gives decision makers the real-time data they need to gain a competitive advantage.

As we enter the second decade of this data revolution, not utilizing such tools puts companies at a competitive disadvantage. Nonetheless, many small businesses fail to maximize data-based analytics, despite their well-established return on investment. Most of these companies own proprietary data that could be beneficial in terms of performance, but they either fail to recognize the full value of this information or are daunted by barriers to access and usability. Many fall into the trap of over-analyzing internal historical information about themselves, like internal costing and profitability analysis, because even the smallest companies have relatively powerful ERP systems for order processing and accounting, is the only data available for rigorous review.

For example, all companies gather customer data, but often it is not digitized in a usable format that lends itself to easy analysis. Some details may be kept in a spiral notebook, a sales rep’s phone, or even in erasable ink on a conference room whiteboard, but one thing is certain: There remains a significant gap between the ability of many smaller organizations to generate and to analyze insightful future-looking data, especially “soft data” like customer preferences and buying behavior.

Fortunately, there are scalable solutions small companies can now afford. Some track and analyze customer contacts. Others reveal demographics, trends, and purchase patterns. Once installed, the best tools do not require a technical team to sustain them, but there are some key requirements that must be implemented to maximize the tool’s capabilities.

How I helped one small company use a simple CRM to increase pipeline visibility and profits.

A few years ago, I was hired as the strategic marketer for a small manufacturer of medical diagnostics equipment. As I was getting oriented during the first week or two, I received an unexpected invitation from the CFO to attend the monthly cash flow meeting. I certainly understood the importance of cash flow, having been responsible for the full P&L of several international subsidiaries with a prior employer, but as the marketing lead on this assignment, I thought it was a little odd for me to attend this meeting. Nevertheless, I went.

The CFO ran the meeting, which was also attended by the sales team, the CEO who doubled as the chief salesperson, and the company operations and R&D managers. The topic that day wasn’t just cash flow, but the lack of it. The factory was busy, but the operations manager was worried that there were not enough incoming orders to keep the workers productive in future weeks, and the CFO was concerned about being able to meet payroll in future months. They needed more visibility of future product orders to be able to plan factory capacity and to project future cash flows.

The meeting participants circled themselves around the CEO’s white board which listed the top ten opportunities for product orders. As he moved down the list, asking for updates about each prospect, he heard some products lacked certain features and that further R&D development was required. For other opportunities the CEO learned that there were two other competitors for the potential sale, but the sales reps felt confident they could win. Other potential clients who required special attention were discussed, but were not even listed on the whiteboard.

As the meeting wound down, I asked, “Is this meant to be a prioritized list of all our opportunities? We talked about a couple that are not even on the board.”

“Oh no,” explained a team member. “We probably have a hundred opportunities.”

“Where can I view the other ninety?” I asked.

Everyone chimed in: “Well, you know, some of it is in our emails. We’re waiting to hear back from some clients, others we have not heard from in a long while. We also presented a great paper at the recent symposium and got lots of positive feedback. Plus, there’s disruption in the market with one competitor being bought by their huge distributor. For sure there are lots of new opportunities emerging.”

In short, this whiteboard fell short of providing a meaningful overview of the company’s order prospects and therefore was a poor predictor of its future cash flow. No wonder the CFO always looked stressed out.

The following day, I visited the CEO and said, “Listen, to get real insight into the company’s cash flow problems, we need visibility of all the order opportunities including the potential order value, the win-probability, and the likely closing date for each and every opportunity. After that, I explained, we can forecast the order flow rate, and the CFO can forecast the cash flow.

“Doing so will also help us manage the order pipeline. We can determine a next step for each opportunity and who is going to take it, by a given due date. In addition to assigning an overall owner for each step, you may want to assign an overall owner for each opportunity as well. You need a Customer Relationship Management (CRM) system.”

“That sounds pretty complicated,” the CEO replied.

“It's complex -- not complicated,” I explained. “Just ask your employees to give me standardized information about every opportunity that they have. They can send it by email, write it on a cocktail napkin, or tell me in person, but to build a comprehensive list, we need to know every sales opportunity that exists right now. As new opportunities emerge, we will add them to the list.”

“That can be done,” said the CEO.

“And this is really critical,” I added. “You must instill in your organization the idea that every interaction with every customer has potential value and should be captured and recorded in that centralized location. I’ll set it up so they can update the records themselves, but if they find it too complicated, the sales team and I will update the records ourselves, if they give us the information.”

“That sounds even more complicated.”

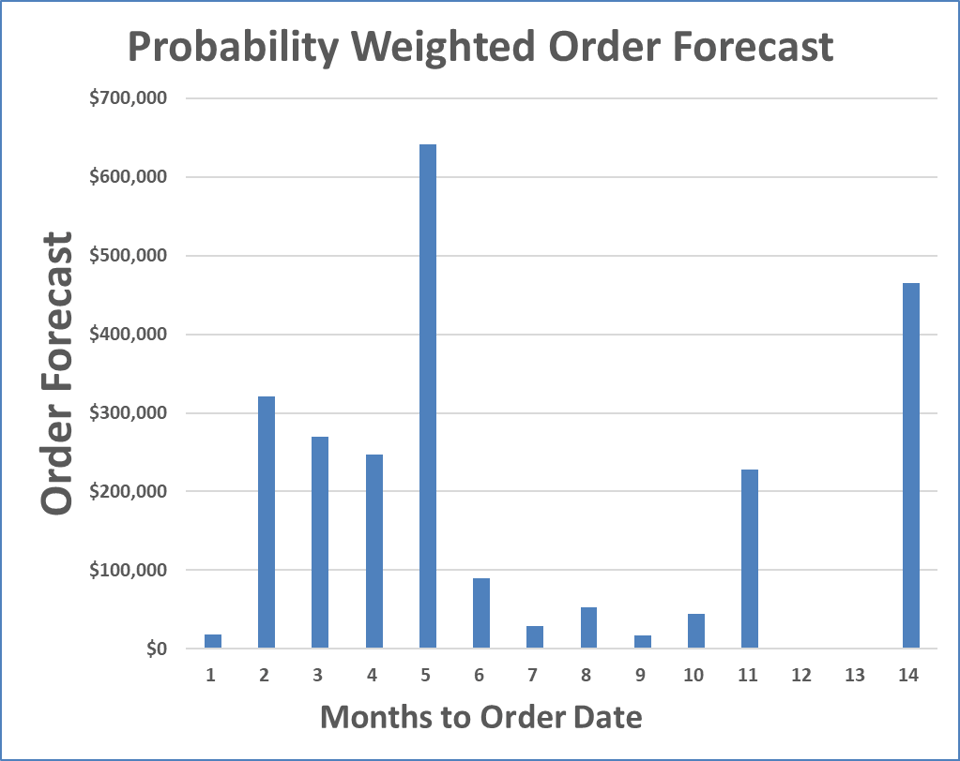

I assured him it could be done and we began building the list. Over the following weeks, this humble snapshot of opportunities evolved into a robust spreadsheet that automated many calculations and produced useful graphics. Below you can see two images that reflect some of what we learned.

The first image is a forward-looking order flow, weighted for the probability of conversion to a sale. As an example, if we were one of two competitors looking for the same sale, and we didn’t have any particular advantage, then our probability of conversion was 50% or less, depending on the details. So, for that example, if a sale would net $100,000, and it was assessed at 50%, then $50,000 was added to the weighted probability order forecast.

The above order forecast highlights urgent business issues:

- Next month’s forecast order rate is very low.

- In five months, there is a logjam coming.

- More opportunities are needed 6 to 12 months from now.

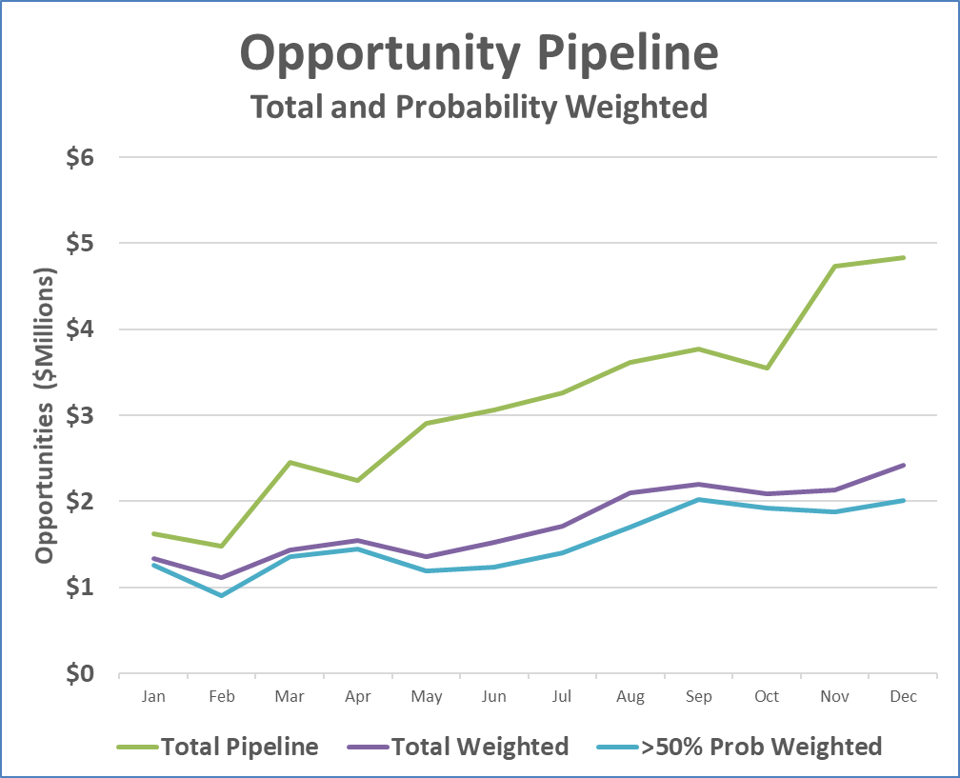

Using this simple tool for many months, we were able to track whether we were adding to the opportunity pipeline, or whether it was shrinking. As you can see above, over the course of a year, we more than doubled the total value of all opportunities in our pipeline.

Using the second chart below, because each opportunity was also linked to a probable closing date, we could forecast future orders. Although few orders were expected for the coming month, the data showed a logjam of orders for the fifth and fourteenth months. This knowledge empowered the sales reps to manage customer expectations about delivery times and gave them a talking point to encourage some clients to move their delivery dates up by a month or more. It also revealed that there was a critical need to generate opportunities for slower months.

Actual opportunity data shows order forecasts, in three formats:

1) Total of all Opportunities - Unweighted

2) Total - Weighted

3) High Probability - Weighted

This true story illustrates several key requirements for a good CRM system. First, whether you use advanced software or a simple spreadsheet, having all your customer information in a single system is critical to enhance visibility and analysis.

Second, you also need buy-in from the top down that everyone relevant to the process is required to contribute data. A CRM will not provide meaningful insights if some sales reps use the tool, but others insists on tracking opportunities in a paper notebook. To achieve this, the top authority in the company must explain to every employee that participation will help them succeed personally and for the company to succeed collectively, by gaining stronger customer insights. As you’ll see below, it is a lot easier to promote a system internally if the CRM makes their jobs easier, and becomes a part of their jobs, rather than becoming an additional burden on top of their current responsibilities.

Lastly, I want to add that I am agnostic about the CRM’s technical platform. Just as all companies are not the same, neither do they all need the same tools for CRM. There are many ways to track customer data, so long as the process for doing so is standardized across the company, the tool fits the job, a competent person/team is designated as the tool owner, and the initiative gets support from the senior executives. The bottom line is that I seek to recommend the most cost-efficient tool for the specific client I represent. To find out what system I personally use, read on.

I used CRM to reposition my own company.

Since starting my Fractional CMO consultancy, nearly every customer that I’ve run across either has a CRM that they hate, or they have no CRM at all. I’ve used free on-line tools that have great initial appeal but lack the ability to scale and grow with the business. I’ve seen huge, expensive CRMs maintained by large staffs who spent all their time configuring and massaging data before most members of the sales team even use the tool. Although these large systems may be the most effective solution for complex configurations requiring integration with other existing legacy systems, they certainly would not appeal to the average small to mid-sized business owner. It doesn’t have to be that way.

About two years ago, a client asked me to become a user in their HubSpot CRM portal. This client made the request so I could view their customer interactions, so I could be assigned tasks or customers myself, and of course so I could also add notes about customer interactions on my own. But not only could I add data, HubSpot also kept track of many customer interactions automatically, including website views, pricing inquiries, and many other interactions. I was so impressed with the elegant simplicity of this intuitive HubSpot interface, that I adopted it for Global Launch as well.

After using and reviewing my own company’s Opportunity Pipeline, the HubSpot data convinced me that many of my potential customers believed that they did not currently need, or could not afford my fractional CMO services on a long-term basis. It became clear that I could increase the number of clients I served, by offering my services on narrower engagements, focused on implementing the HubSpot toolset, instead of only hiring myself out as a fractional marketer on a long-term basis. That’s how Global Launch’s Fractional CMO concept was adapted to create this HubSpot service offering.

Where should your company start?

If business data analysis is new to your company, begin with an assessment of what “low-hanging fruit” is available and how data insights might improve your overall performance. Next, design the processes and systems to optimize data capture and utilization. Lastly, access and package the analysis to inform your strategic decision making. If you are like most companies who dive into data analysis, the return on investment will far exceed the cost of your tool. But what about personnel? How can you ensure that data analysis truly supports your company goals?

You could hire a dedicated full-time Chief Marketing Officer (CMO) with a strong data background to help you select the right tool for the job, tailor it to your goals, and map out supporting processes. The problem is that finding a CMO with data expertise is not easy. So many companies seek the same thing that the U.S. Bureau of Labor Statistics lists data science as one of the fastest growing occupations in America with a median wage that topped $100,000 annually, even before our recent bout with inflation.

However, there is a consultancy option that could save your company money, while still garnering impressive results. Global Launch’s Fractional CMO approach unleashes the power of innovation by:

- Prioritizing your investments into solutions that match your business objectives;

- Organizing and analyzing data in a manner that aligns with your needs;

- Providing an experienced marketing executive without risking the expense and overhead of hiring another full-time C-level employee.

Thanks to this fractional approach, even the smallest companies can afford to participate in the data revolution.

Selecting the right CRM for your company.

Even the free version of HubSpot is perfect for many small companies, including dashboards that put many standard business reports in one location, the ability to sort Contacts or Companies by hundreds of fields, the ability to assign and track tasks, and powerful sales tools that make it one of the best software tools for small businesses. For larger companies and even enterprise-scale corporations, subscription versions offer even more robust coordination, insights, and transparency, all capable of growing and scaling over time, as your company grows.

Of course, HubSpot is not the only CRM on the market. If your company uses Salesforce or other tools, for example, I can still help your company set up the theoretical framework for customer management.

As a certified HubSpot provider with decades of CMO experience, I bring expertise on all the ways this powerful tool can be implemented. I can also call-in technical experts from my professional network to accomplish specific CRM tasks on an as-needed basis. This robust flexibility means that Global Launch offers expertise that is robust, proficient, and affordable.

If you are looking for a cost-effective way to implement or improve CRM systems and processes, visit the Global Launch website at GlobalLaunch.Net, or Meet with us to set up an initial discussion. I’d be happy to hear about your dreams and needs, and whether our fractional approach is a match for your company’s mission and budget.